The Ultimate Guide To Pacific Prime

Wiki Article

The 3-Minute Rule for Pacific Prime

Table of ContentsThe Greatest Guide To Pacific PrimeFascination About Pacific PrimeGetting The Pacific Prime To WorkFacts About Pacific Prime RevealedGet This Report on Pacific Prime

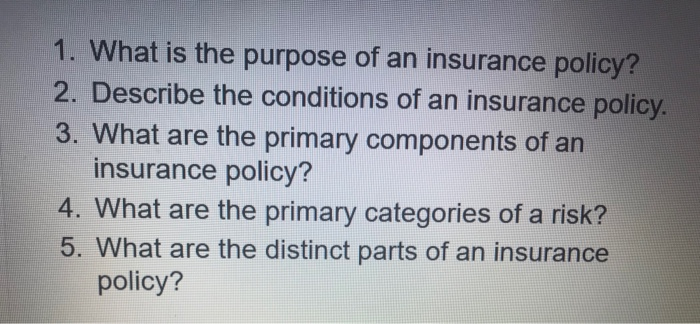

Insurance is a contract, represented by a plan, in which an insurance holder gets financial defense or repayment versus losses from an insurance policy company. The business swimming pools customers' dangers to pay more budget-friendly for the insured. The majority of individuals have some insurance policy: for their vehicle, their residence, their health care, or their life.Insurance policy also aids cover expenses linked with liability (lawful obligation) for damages or injury created to a 3rd party. Insurance coverage is an agreement (policy) in which an insurer indemnifies another against losses from specific backups or hazards. There are several sorts of insurance coverage. Life, health, house owners, and auto are among the most usual forms of insurance.

Investopedia/ Daniel Fishel Several insurance coverage kinds are available, and basically any kind of specific or business can discover an insurance provider going to guarantee themfor a price. Typical individual insurance coverage kinds are vehicle, wellness, property owners, and life insurance. A lot of individuals in the United States contend the very least among these kinds of insurance coverage, and automobile insurance policy is needed by state legislation.

The 5-Second Trick For Pacific Prime

Discovering the cost that is ideal for you needs some research. Optimums may be set per duration (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally understood as the lifetime maximum.

Policies with high deductibles are normally less costly due to the fact that the high out-of-pocket expense generally causes less tiny insurance claims. There are various types of insurance coverage. Allow's look at the most important. Health insurance policy aids covers routine and emergency situation healthcare prices, often with the alternative to add vision and dental services individually.

Several preventive services may be covered for complimentary before these are fulfilled. Wellness insurance might be acquired from an insurance coverage firm, an insurance coverage agent, the government Health Insurance Market, offered by a company, or federal Medicare and Medicaid protection.

The Buzz on Pacific Prime

redirected here

The firm then pays all or many of the covered expenses linked with a car crash or various other vehicle damages. If you have a rented vehicle or borrowed cash to buy an auto, your loan provider or renting car dealership will likely require you to bring vehicle insurance coverage.

A life insurance policy plan guarantees that the insurance company pays an amount of cash to your beneficiaries (such as a spouse or children) if you die. In exchange, you pay costs during your lifetime. There are 2 major types of life insurance policy. Term life insurance policy covers you for a particular period, such as 10 to two decades.

Insurance policy is a means to handle your economic threats. When you buy insurance coverage, you buy defense versus unforeseen economic losses. The insurance coverage company pays you or a person you select if something poor takes place. If you have no insurance policy and a mishap occurs, you might be accountable for all associated costs.

8 Simple Techniques For Pacific Prime

There are several insurance coverage policy kinds, some of the most typical are life, wellness, house owners, and car. The right sort of insurance coverage for you will certainly depend on your objectives and financial scenario.

Have you ever before had a minute while looking at your insurance plan or looking for insurance policy when you've believed, "What is insurance coverage? And do I really need it?" You're not the only one. Insurance can be a mystical and confusing point. Just how does insurance job? What are the benefits of insurance coverage? And just how do you find the finest insurance policy for you? These are common concerns, and the good news is, there are some easy-to-understand responses for them.

No one desires something bad to happen to them. Suffering a loss without insurance policy can put you in a hard financial circumstance. Insurance coverage is a vital economic device. It can aid you live life with fewer worries knowing you'll obtain economic aid after a disaster or accident, helping you recoup much faster.

Examine This Report about Pacific Prime

And in many cases, like car insurance coverage and employees' settlement, you may be required by regulation to have insurance policy in order to safeguard others - group insurance plans. Discover ourInsurance choices Insurance coverage is essentially a massive rainy day fund shared by lots of people (called insurance holders) and handled by an insurance coverage carrier. The insurer uses cash accumulated (called premium) from its insurance policy holders and other investments to spend for its operations and to meet its guarantee to insurance holders when they sueReport this wiki page